- Published on: 9 Oct 2025

- Last updated on: 8 Dec 2025

- Post Views: 10934

There are over 1.51 crore active Goods and Services Tax (GST) registrations in India. GST registration not only enables seamless business operation but is also mandatory for tax compliance for businesses whose turnover exceeds ₹40 lakh. While the GST registration documents required changes depending on the type of business entity, no process can ever be completed without them.

Without the correct GST registration documents, an application can either get delayed or even rejected. In this blog, we’ll understand the important GST registration papers you need to register your business legally.

GST registration is obligatory for all suppliers since GST is a tax on the occurrence of supply. GST registration is not required if you trade only 0% GST items like grains or pulses, irrespective of the turnover. However, you are required to register for GST if your business turnover exceeds ₹40 lakh and ₹20 lakh in special category states. Here is everyone who needs to register for GST:

As per Notification No. 5/2017-Central Tax, suppliers whose goods or services are fully taxable under reverse charge (where the buyer pays the tax) don’t need to register under GST.

Here are the GST documents you must keep ready when you are applying for GST registration:

| Purpose | Documents | Document Type | Document Size |

| Identity | Aadhaar Driving License PAN | JPG or PDF | 1 MB |

| Address Proof | Property Tax Receipt, Municipal Khata copy, Electricity Bill, Rent / Lease Agreement Consent Letter, Documents / Certificate issued by Government | JPG or PDF | 1 MB |

| Partnership Dee,d Trust Deed Certification of Incorporation, Any proof substantiating Constitution Certificate for Establishment Registration Certificate | Proof of the Constitution of Business | JPG or PDF | 1 MB |

| Photo of Stakeholder | Photo verification | JPG | 100 KB |

| Photo of Authorised Signatory | Photo | JPG | 100 KB |

| Proof of Appointment of Authorised Signatory | Proof of Principal Place of Business | JPG, PDF | 100 KB |

| Property Tax Receipt, Municipal Khata copy, Electricity Bill, Rent / Lease Agreement Consent Letter, Documents / Certificate issued by Government | Property Tax Receipt, Municipal Khata copy, Electricity Bill, Rent / Lease Agreement, Consent Letter, Documents / Certificate issued by the Government | JPG, PDF | 100 KB |

| Proof of Additional Place of Business | Property Tax Receipt, Municipal Khata copy, Electricity Bill, Rent / Lease Agreement Consent Letter Documents / Certificate issued by Government | JPG, PDF | 100 KB |

| Entity | Documents |

| Proprietor / Individual Business | PAN card of all the partners, including the managing partner, Aadhaar of the authorised signatory, a Copy of the partnership deed or certificate of LLP registration, a Photograph of all the partners, Proof of address of the partner,s Bank details Letter of authorisation for the person applying on behalf of the firm |

| Partnership Firm / LLP | PAN card of all the partners, including the managing partner, Aadhaar of the authorised signatory, a Copy of the partnership deed or certificate of LLP registration, a Photograph of all the partners, Proof of address of the partners, Bank details Letter of authorisation for the person applying on behalf of the firm |

| Company (Private or Public) | PAN of the company Certificate of Incorporation issued by the Ministry of Corporate Affairs Memorandum of Association (MoA) and Articles of Association (AoA) PAN and Aadhaar of directors and authorised signatories Board resolution for the sanction of the signatory Photographs of Directors Bank proof Proof of the head office address |

You can apply for GST registration online. Here is how you can upload the documents for the GST registration:

Step 1: Visit the GST Website: www.gst.gov.in

Visit the official GST website. You can click here or manually visit the website at www.gst.gov.in.

Step 2: Click on ‘New Registration’

Drag your mouse to “Services”, then “Registration”, and finally click on “New Registration”.

Step 3: Provide Basic Details

Provide basic personal and business details like the type of entity, state, district, and legal name of the business, business email ID, PAN, and mobile number.

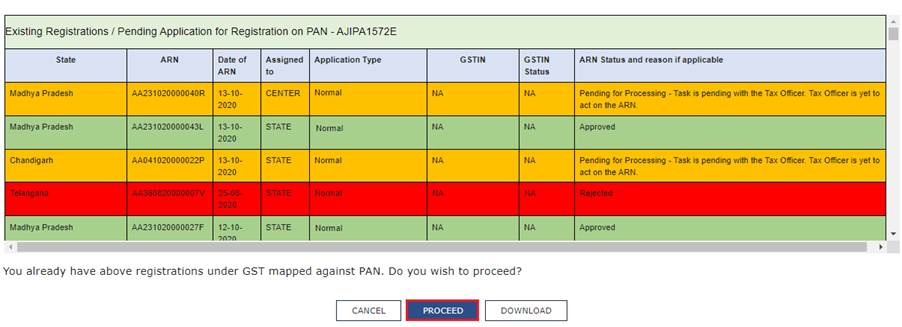

Step 4: Check If You Have Applied Before

You can see if the application is pending or rejected if you have applied for the GST registration before. If the account is new, proceed to the next step.

Step 5: Verify via OTP and Receive TRN (Temporary Reference Number)

You will receive an OTP at your email address and mobile number once you have submitted all the necessary details. After entering these OTPs in the appropriate fields, click Verify. A Temporary Reference Number, or TRN, will now be assigned to you. The unique 15-digit reference number is TRN.

Step 6: Upload the GST Registration Papers to Fill out Part B of the Form

Enter the TRN number into the GST portal to continue. Here, you must upload all the necessary documents in the format and size as mentioned by the GST portal. Complete Part B of the form after logging in.

Step 7: Submit via DSC or EVC

Submit the application through EVC or DSC. You must also upload the handwritten signatures. To see your DSC’s details, click the View Certificate button.

Step 8: Receive ARN (Application Reference Number)

After your application is successfully submitted, you will receive an Application Reference Number (ARN). This confirms that your application was received and processed.

Here are some common mistakes you must avoid when uploading the GST registration documents, as they can lead to delay or rejection:

GST registration is mandatory for almost every business. However, if you want the process to go smoothly and your application to get approved, you should know what GST documents are needed and have them ready. Make sure that you scan all your documents without any mistakes.

1. Do I need both PAN and Aadhaar for GST registration?

Yes, if you’re registering for a business, you need the business’s PAN and Aadhaar from the applicant or authorising signatory.

2. What if my Aadhaar is not linked to my mobile number?

You cannot proceed with Aadhaar authentication if your mobile number is not linked.

3. Can I use a savings account for GST registration?

Yes, but it is preferable to have a current account in the business name for easy, hassle-free compliance.

4. What documents are accepted as proof of business address?

An electricity bill, property tax receipt, rent agreement, or owner’s NOC are all the documents that you can upload.

5. Do all directors of a company need to submit PAN and Aadhaar?

Yes, all the directors must provide the proof of identity along with the authorised signatory.

6. Is a photograph necessary for all types of GST registrations?

Yes, the GST registration requires you to submit passport-sized photographs.

7. How do I submit my bank proof?

You can upload a cancelled cheque, bank statement, or a copy of your passbook account details.

8. Can a business run without a GST certificate?

No, if GST registration is mandatory for your business, you must obtain the certificate before operating.

9. What if I upload the wrong document?

Your application can get rejected or delayed. You can reapply with the proper GST application documents.

10. How long does it take to get the GST certificate after applying?

If all GST registration papers are correct, it usually takes 3–7 working days.