- Published on: 25 Sep 2025

- Last updated on: 5 Feb 2026

- Post Views: 78157

In India, the growing use of credit cards, consumer loans, and EMIs has made it easier than ever to access credit. However, juggling multiple loans and repayment dates often leads to stress, late payments, and higher interest burdens.

A personal loan for debt consolidation is one of the simplest ways to manage this challenge. Instead of handling multiple EMIs at different interest rates, you can combine them into one single loan with a fixed EMI. This blog explains what debt consolidation means, why it matters, and how DMI Finance personal loans can help you consolidate debt in a simple and effective way.

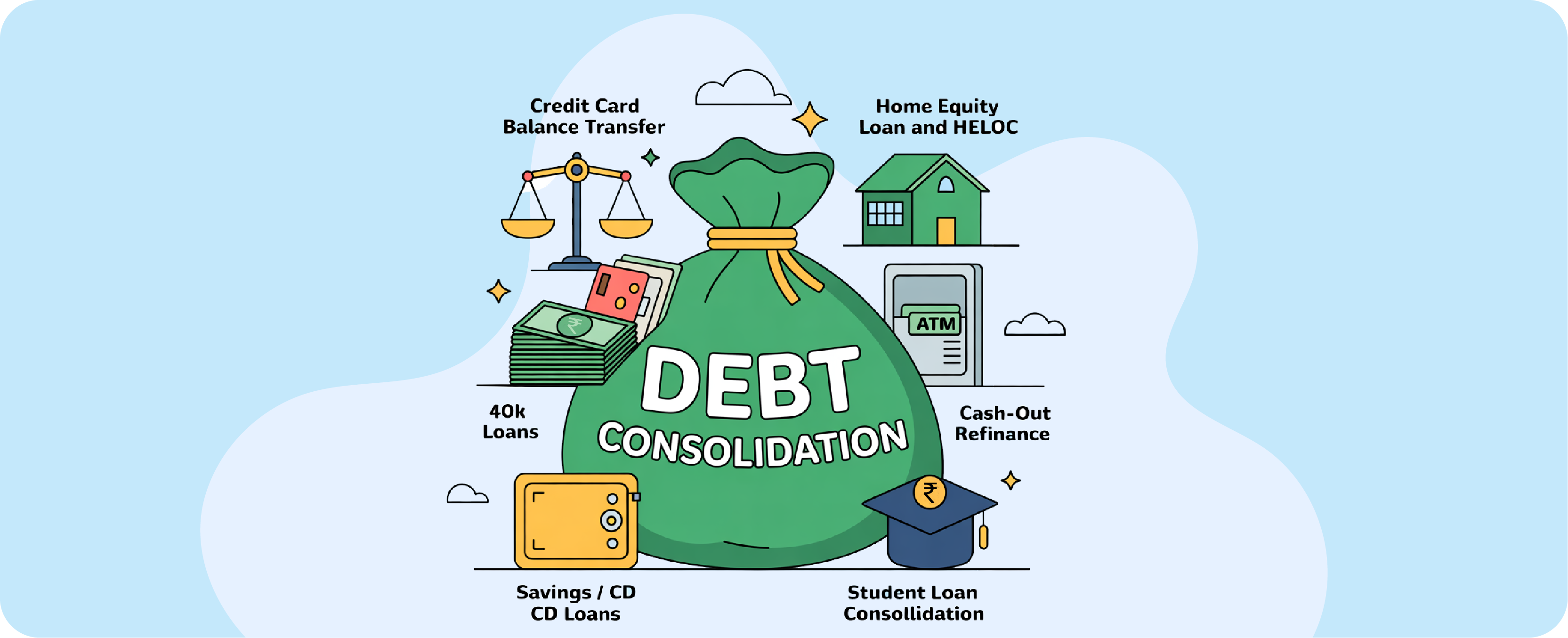

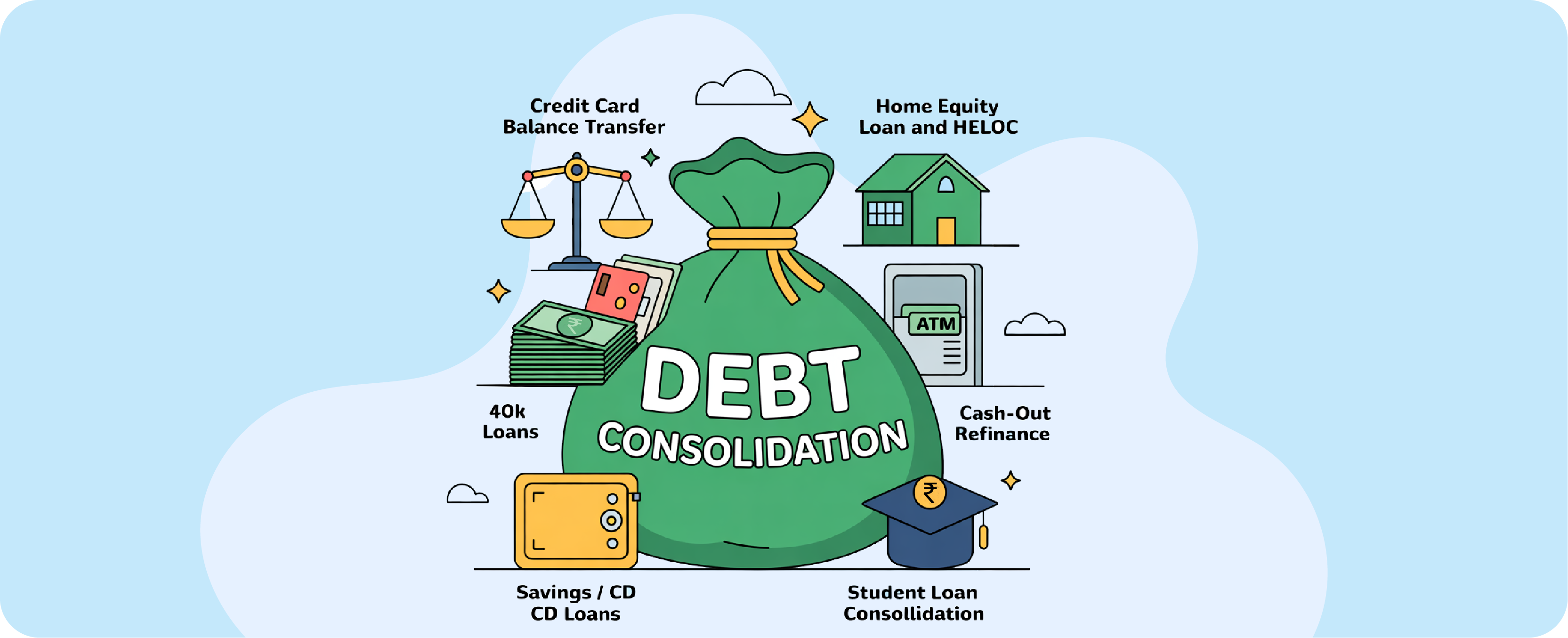

Debt consolidation means combining multiple outstanding debts, such as credit card bills, personal loans, or consumer durable loans, and paying all of them by taking one loan.

Example: If you’re paying ₹2 lakhs across three credit cards and one consumer loan, you can replace them with one debt consolidation loan in India, and one only EMI every month.

Choosing a loan to consolidate debt has several advantages:

Here’s how a debt consolidation loan in India typically functions:

Example Calculation:

Calculate your EMIs: Personal Loan EMI Calculator

Here are the eligibility criteria for the DMI Finance personal loan, which can be used to consolidate existing debt.

| Criteria | Value |

| Minimum Age | 23 years |

| Minimum Monthly Income | ₹25,000 |

| Minimum Credit Score | 700 |

| Employment Type | Salaried Self-employed |

To apply for a debt repayment loan in India, you will need the following documents:

Here’s the step-by-step application process:

You will receive the funds directly into your bank (within 24–72 hours).

Once you consolidate debts with a personal loan for debt consolidation, managing repayment becomes easier. Here’s how to stay financially disciplined:

A personal loan for debt consolidation is a smart way to simplify repayments, reduce interest costs, and improve financial health. Instead of struggling with multiple EMIs, one well-structured loan can give you peace of mind.

If you’re ready to manage your debts smartly, DMI Finance offers simple, transparent, and collateral-free personal loans to help you consolidate your debts with ease. Click here to apply.

Q1: What is a personal loan for debt consolidation in India?

It’s an unsecured personal loan used to pay off multiple existing loans or credit card dues, replacing them with a single EMI.

Q2: Can I use a personal loan to pay off credit card debt?

Yes. A credit card consolidation loan in India helps pay off expensive card balances at lower interest rates.

Q3: Is it better to consolidate debt with a personal loan or a balance transfer?

With a balance transfer, you can transfer your remaining loan or credit card bill to a new lender, and with debt consolidation, you can pay all your loans by taking a new loan and paying a single EMI.

Q4: What is the eligibility for a debt consolidation loan in India?

With DMI Finance, you must be 23+, earn at least ₹25,000 per month, and have a credit score of 700+.

Q5: How much personal loan can I get for debt consolidation with DMI Finance?

You can borrow between ₹50,000 and ₹5,00,000, depending on your income and credit profile.

| Personal Loan of Different Amounts | ||

| ₹50,000 Personal Loan | ₹1 lakh Personal Loan | ₹2 lakh Personal Loan |

| ₹3 lakh Personal Loan | ₹4 lakh Personal Loan | ₹5 lakh Personal Loan |