- Published on: 6 Jun 2025

- Last updated on: 18 Feb 2026

- Post Views: 4397

If you have ever applied for a loan or a credit card, you may have heard of the term credit score. But what exactly is a credit score, and why is it important? Your credit score plays a crucial role in the decisions made by lenders (banks, NBFCs, and credit institutions) when you apply for any loan or a credit card. This blog covers everything you need to understand about credit score, how it works, and its importance.

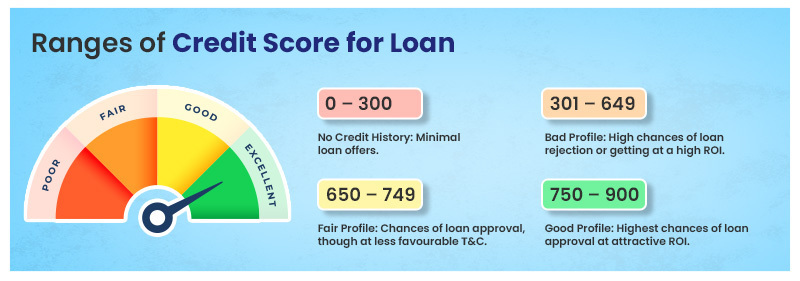

A credit score is a three-digit number between a range of 300 to 900. It shows how well you’ve handled the money you’ve borrowed in the past. The closer the number is to 900, the better. It helps lenders understand how likely you are to pay back a loan on time. In short, your credit score helps them decide how risky it is to give you a loan or any other credit product.

Purpose of a Credit Score:

Your credit score and credit report are closely related, but they are not the same. A credit report is a detailed record of your credit history. It includes information about your credit accounts, payment history, outstanding balances, and recent credit inquiries.

On the other hand, a credit score is a three-digit number that summarises your creditworthiness based on the information in your credit report.

A credit score is used by:

| Users | Purpose |

| Banks & NBFCs | Decide on loan approval and rate of interest (ROI) |

| Credit Card Companies | Evaluate credit card eligibility |

| Credit Institutions | Offer loans and credit lines |

| Employers (In Some Cases) | Assess financial responsibility. |

They check your credit report from credit bureaus like Equifax, Experian, Crif Highmark, and TransUnion Cibil.

Understanding why the credit score is important can save you time, money, and stress. Whether you are applying for a personal loan, home loan, car loan, or credit card, your credit score plays a key role in the approval process and terms offered. Here’s how:

1. Loan Approvals

2. Interest Rates

3. Credit Card Limits and Approvals

4. Other Uses

Here are the major factors that influence your credit score:

Keeping your credit score safe is important for maintaining strong financial health. Here’s how you can do that effectively:

Understanding what a credit score is and its importance is crucial for your financial health. Whether you are aiming for a loan or a new credit card, maintaining a good credit score makes life easier. Follow responsible borrowing habits, check your credit score regularly, and fix errors to stay credit-ready!

1. What is a credit score, and why is it important?

A credit score is a three-digit number that shows how creditworthy you are. Lenders use it to assess the risk of giving you a loan or credit card. A higher credit score increases your chances of approval.

2. What factors impact your credit score the most?

The main factors affecting your credit score are payment history, credit utilisation, length of credit history, new credit inquiries, and credit mix. The most important factors are paying on time and keeping your credit utilisation low.

3. How can I check my credit score for free in India?

You can check your credit score for free once a year from credit bureaus like TransUnion CIBIL, Experian, Equifax, and CRIF Highmark. DMI Finance also offers free credit score checks. Download the DMI Finance app and check your credit score for free as many times as you want.

4. Does checking your credit score lower it?

No, checking your credit score yourself is considered a soft inquiry and does not lower your score. However, when lenders check it for loan approval, it is considered a hard inquiry, which may slightly impact your score.

5. What is the difference between a credit report and a credit score?

A credit report is a detailed record of your credit history, while a credit score is a three-digit summary of that report. Lenders use both to assess your creditworthiness.

6. What credit score is considered bad in India?

In India, a credit score below 600 is usually considered bad. It may lead to higher interest rates or loan rejection.

| Term | Definition |

|---|---|

| Creditworthiness | A lender’s assessment of how reliable you are when it comes to repaying loans. |

| Credit Product | Any financial product that allows you to borrow money, such as a credit card or personal loan. |

| Financial Behaviour | Your habits and history of using, repaying, or managing credit and loans. |

| Identity Theft | A type of fraud where someone uses your personal information/ documents to take loans or access credit in your name. |

| Dispute (Credit Report) | A formal complaint you file with a credit bureau if you find incorrect information in your report. |

| Approval Rate | The chances of your application getting approval for a loan, credit card or any credit product. |